OTHER WAYS WE HELP

PROVIDING YOU

with easy to understand answers

Leasing

What are the benefits of leasing?

Working with a franchise organization with local ownership of our street-front locations, James gives you a committed, local-office presence with a team that understands your market, is in your time-zone, and has community-involvement and knowledge. James offers the best tools, underwriting centre, and efficiency in the leasing business today.

With leading funding resources, James provides the best opportunity for approvals with the lowest monthly payments.

Why rely on only one or two lease-sources when you can have over 30 specialty lease-funding sources in Canada and the United States?

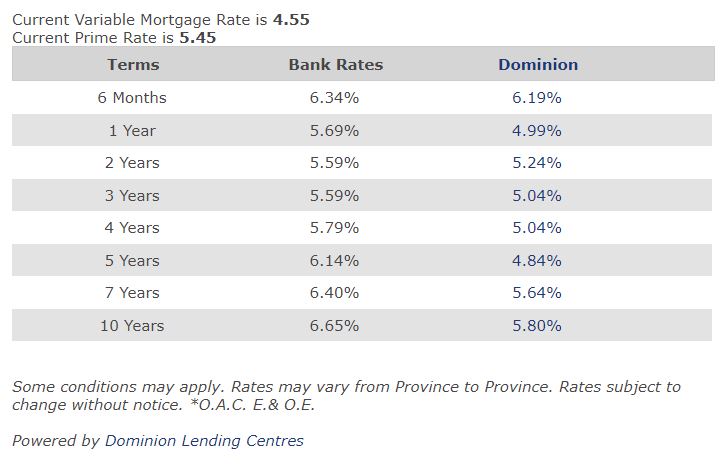

Current Rates

Current Mortgage Rates

Please Note: Some conditions may apply. Rates may vary from Province to Province. Rates subject to change without notice. Posted rates may be high ratio and/or quick close which can differ from conventional rates. *O.A.C. & E.O

Please Note: Advertised rates are not guaranteed and the rate provided by any financial institution listed, or any approval or decline you receive, will be based solely on your personal situation. The advertised rates are provided as guidance only and the accuracy of these rates is not guaranteed. You are encouraged to speak with a Dominion Lending Centres Mortgage Professional for the most accurate information and to determine your eligibility.

Mortgage Insurance

Mortgage insurance ensures your family financial protection

Mortgage Insurance is here for you and your family if the unexpected happens. It can help ensure their mortgage payments are made and their loved ones are taken care of. That’s some certainty in a future that’s uncertain.

With the rise of illness, household debt at an all-time high, and Canadians carrying bigger mortgages, financial protection is more important today than ever.

Bad Credit

What is Bad Credit?

A person with bad credit may find it more difficult to obtain a loan. Someone who is regarded as having bad credit, is a person who owes too much money or has a history of not paying their bills on time. Bad credit can also be reflected by having a low credit score.

But there are steps you can take to improve your credit and make yourself eligible for a loan or mortgage. James will help you take these steps and provide you with options that will give you the best positioning.

Private Lending Solution

Is there a lending solution for you?

James offers a wide range of lending solutions for people with unique needs. Don’t let your search stop at ‘no’! There are lots of solutions outside what a bank or private institution can provide.

Contact James today to find out more about what unique lending solutions are available to you!

Bank Statement Verified

How to get Bank Statement Verified

If you’re seeking a mortgage, the first step is to be approved by a lender. Banks may require a verification or proof of deposit form to be completed and sent to your bank in order to verify your financial information. The proof of deposit may require you to provide at least two months of bank statements.

James will walk you through what you need to do and what forms to obtain to ensure that you get approved for your mortgage to purchase or improve a home.

HELOC/Home Equity

Do I qualify for HELOC?

One of the greatest benefits of homeownership is the ability to build equity over time. Home Equity Line of Credit (HELOC) can secure you low-cost funds. Home equity can be a great source of value for homeowners to access money (with a fixed interest rate) for large purchases, alternative debt repayment, or renovations.

Home equity loans and lines of credit are secured against the value of your home equity, James will find rates that are lower than they would be for most other types of personal loans.

Each Office Independently Owned & Operated"

"Having been a skilled trades-person for 18 years, I've seen plenty of cases where people making a very good income are poorly treated by some lenders. I want to help put the people building homes, INTO homes."

James

Contact Info

Dominion Lending Centres

FC Funding FSRA#10671

London Office

1 Commissioners Rd East

London, ON N6C 5Z3

Phone: 647 617 7158

Email: james@bluecollarmortgages.ca